Agency Report

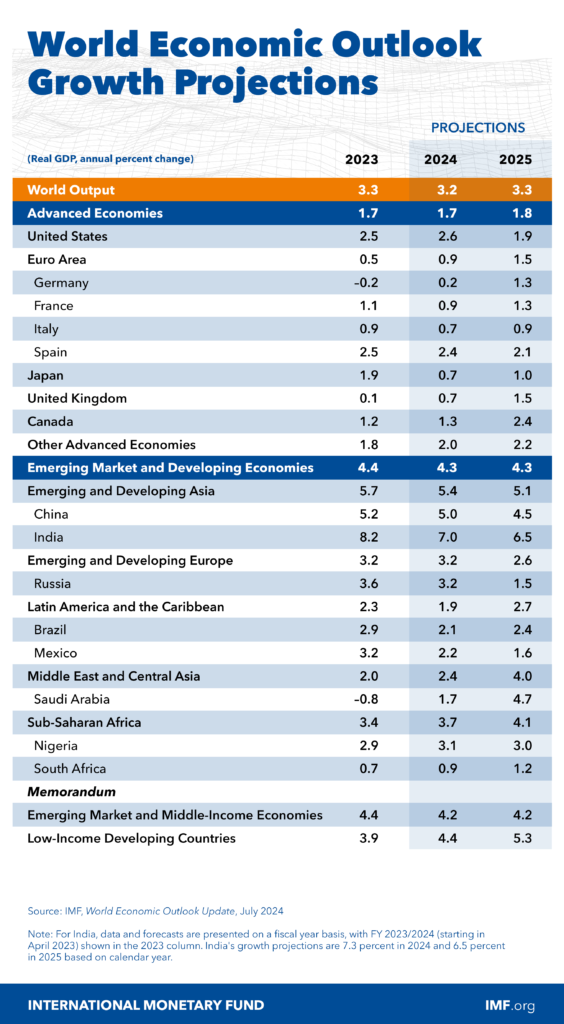

The International Monetary Fund (IMF) has reduced its forecast for Nigeria’s economic growth to 3.1 percent in 2024 — down from a 3.3 percent projected in April.

The downgrade is 0.2 percentage points below the prior forecast.

In its July 2024 World Economic Outlook released on Tuesday, IMF said a lower-than-expected activity in the first quarter (Q1) of the year impacted decisions for the downgrade.

The IMF, however, retained a 3.0 percent forecast for Nigeria’s economic growth in 2025.

Revealing further, IMF downgraded its forecast for sub-Saharan Africa economic growth in 2024 to 3.7 percent — from the April forecast of 3.8 percent.

“The forecast for growth in sub-Saharan Africa is revised downward, mainly as a result of a 0.2 percentage point downward revision to the growth outlook in Nigeria amid weaker than expected activity in the first quarter of this year,” the Bretton Woods institution said.

However, IMF increased its forecast for economic growth in the region for 2025 to 4.1 percent — from 4.0 in its April projection.

IMF retained its global economic forecast at 3.2 percent in 2024 and 3.3 percent in 2025.

“Growth is expected to remain stable. At 3.2 percent in 2024 and 3.3 percent in 2025, the forecast for global economic growth is broadly unchanged from that in April,” the international lender said.

“Among advanced economies, growth is expected to converge over the coming quarters.

“In the United States, projected growth is revised downward to 2.6 percent in 2024 (0.1 percentage point lower than projected in April), reflecting the slower-than-expected start to the year.

“Growth is expected to slow to 1.9 percent in 2025 as the labor market cools and consumption moderates, with fiscal policy starting to tighten gradually. By the end of 2025, growth is projected to taper to potential, closing the positive output gap.”

Also, IMF forecasted that global inflation will continue to decline.

“In advanced economies, the revised forecast is for the pace of disinflation to slow in 2024 and 2025,” the Bretton Woods institution said.

“That is because inflation in prices for services is now expected to be more persistent and commodity prices higher.

“However, the gradual cooling of labor markets, together with an expected decline in energy prices, should bring headline inflation back to target by the end of 2025.

“Inflation is expected to remain higher in emerging market and developing economies (and to drop more slowly) than in advanced economies.”

IMF said inflation is already close to pre-pandemic levels for the median emerging market and developing economy partly due to falling energy prices.

KOIKI Media bringing the world 🌎 closer to your door step